Alternative "Spending Routes"

One takes straight to "heaven". The other makes you go "through hell"

This is mostly an update to my previous post, concentrating on the “hereafter”.

The post C-19 aggregate nominal spending (NGDP) trajectory is described in the picture below.

Since early 2021, spending growth went up, taking the level of spending above the level path that prevailed since the end of the Great Recession (GR).

For the past 14+ months, the growth in spending has been falling and it is not far from reaching the 4% “ideal” rate.

The Fed´s choices are clear.

It can allow spending growth to drop to the 4% “ideal” and then keep spending growing at the 4% rate. This would make the level trend path of spending to be permanently above the one that prevailed after the GR. That´s the “soft landing” or “direct to heaven” route.

It can try to force spending back to the original trend level path. If so, for a time

spending growth would have to become significantly negative, with the known dire collateral effects on the economy. We wouldn´t escape a likely deep recession and a big increase in unemployment. That would be the “going through hell” route.

Route #2 would likely materialize if the Fed keeps looking at the labor market to “guide its decisions”.

Things may become clearer by examining the next figure showing the behavior of NGDP growth directly.

“Going through hell” will certainly be very, very, painful!

Whay would the Fed choose the “painful, going through hell” route? It´s been said that Paul Volcker is his “hero”, and that his “mission” is to “strangle inflation.

To Jerome H. Powell, the chair of the Federal Reserve, Paul Volcker is more than a predecessor. He is one of his professional heroes

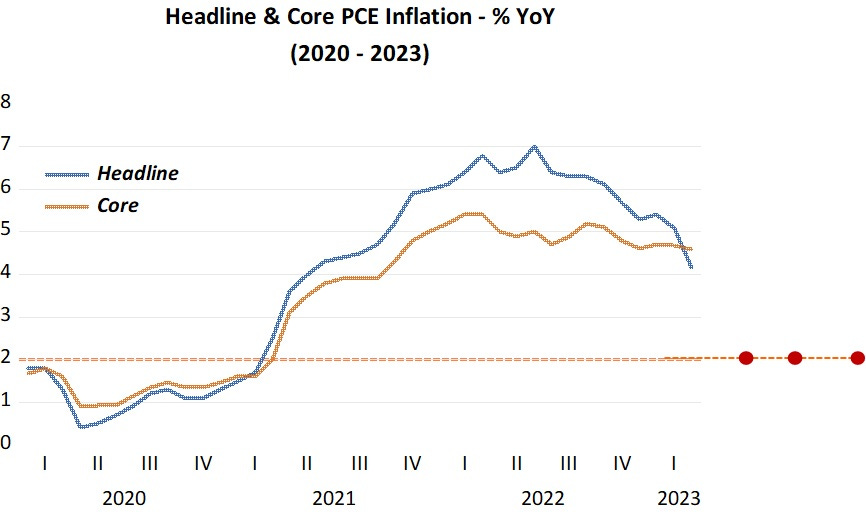

With spending growth slowing down, inflation is also retrenching, but maybe not fast enough to satisfy Powell´s ego”!

How fast he wishes to get to the 2% destination will likely determine the “route” he takes.

Note to my readers: I´ll be away for the remainder of May. My son invited my wife and I to a road trip start point his home in Austin, TX and end point my daughter´s house in Palo Alto. Passing through Santa Fe, Durango (horse back riding in Monument Valley (made a point of rewatching “The Searchers”. When I first saw it in 1958, at age 10, I fell deeply in love with Natalie Wood who was 17 when she made the movie in 1956). Then Moab (“mountain bike capital of the world) crossing Nevada to Reno, Lake Tahoe and Palo Alto.

https://centerforfinancialstability.org/amfm/Divisia_Apr23.pdf

Divisia aggregates shows a contraction in April. But the contraction doesn't begin until June (and maybe a little later because of FedNow instantaneous payments).

Reuters: “These officials also noted the Fed at some point could even lower short-term interest rates as it continues to draw down the roughly $8.5 trillion balance sheet, and that such a move would not be at odds with wider monetary policy.”

The FED should cut interest rates NOW – and continue with QT. The 1966 Interest Rate Adjustment Act is prima facie evidence.