Trump’s Affordability Con Job

And He´s Making It Worse!

There´s a delicious irony in Trump declaring affordability a “hoax” while actively implementing policies that worsen it.

Tariffs: Trump has imposed tariffs estimated to cost the average household approximately $1,700 annually ($900 for bottom-income households).

Tariffs are taxes on imported goods, which means they directly raise prices for consumers. You cannot simultaneously impose $1,700 in new costs on households and claim to be the “affordability president.” Well, you can claim it—Trump claims many things—but the math doesn’t cooperate.

Energy policy: Trump has cancelled various energy projects that might have increased supply and pushed down electricity prices. Remember that electricity costs have surged and were a major factor in recent state elections. Restricting energy supply while demand grows is not an affordability strategy.

Deportations: Trump’s mass deportation campaign targets industries—agriculture, construction, food processing, hospitality—where immigrants are disproportionately represented.

His own DHS officials have warned this threatens “the stability of domestic food production and prices for U.S. consumers.” Deporting the workforce that picks crops, builds houses, and processes food will not lower grocery bills or housing costs. It will do the opposite.

The construction workforce point is particularly important for housing affordability. Housing costs are crushing Americans, driven largely by insufficient supply.

Building more housing requires construction workers. Deporting construction workers reduces supply, which increases prices. This is Economics 101, but apparently beyond the grasp of an administration that claims deportations will somehow lower housing costs (because we´re getting rid of the “illegals”).

Federal Reserve independence: Trump has been systematically attacking the Fed, trying to purge officials he dislikes and install loyalists. This is toxic for longer-term inflation credibility.

If markets believe the Fed will cave to political pressure for lower interest rates regardless of inflation, inflation expectations become unanchored. And unanchored expectations become self-fulfilling through wage-price spirals.

Markets might initially welcome a “dovish” chair who cuts rates, but the longer-term consequence of compromised independence is higher long-term rates as the “independence premium” evaporates and the “risk premium” rises. The path to sustainably low borrowing costs runs through central bank credibility, not through political subordination.

ACA subsidies: Perhaps most directly, Republicans’ refusal to extend ACA subsidies will more than double premiums for millions of Americans in 3 weeks. This is a pure policy choice that directly and immediately worsens affordability.

But extending subsidies would require acknowledging Democrats were right about something, which is apparently worse than letting millions of Americans’ health insurance costs explode.

So why does Trump call affordability a “hoax” while implementing policies that worsen it?

Several possibilities:

1. Deflection: If affordability is fake, you can’t be blamed for failing to address it. It’s the political equivalent of declaring victory over a problem by insisting the problem doesn’t exist.

2. Expectations management: If you convince people their economic pain is manufactured by Democrats/media rather than real, maybe they’ll stop blaming you when policies make things worse.

3. Genuine confusion: Trump may genuinely not understand the difference between inflation rates and price levels, or between nominal and real wages. His economic literacy has never been impressive.

4. Authoritarian rhetoric: As Ruth Ben-Ghiat’s analysis would suggest, declaring inconvenient realities to be “hoaxes” is standard authoritarian practice. If empirical facts are obstacles to your political agenda, attack the legitimacy of empirical inquiry itself.

Whatever the motivation, the consequence is clear: millions of Americans struggling are being told their struggles are fake, even as the administration implements policies that worsen those costs.

But there are things that could help at the margins:

Stop making it worse: Don’t impose tariffs. Don’t deport the agricultural and construction workforce. Don’t sabotage energy projects. Don’t compromise Fed independence. These are all unforced errors.

Extend ACA subsidies: This directly prevents premium doubling for millions. It’s targeted, effective, and immediate.

Housing supply: Facilitate more construction through federal incentives, zoning reform support, and infrastructure investment. This is a long-term play but addresses the core housing affordability problem.

Wage growth support: Policies that strengthen worker bargaining power (without triggering counterproductive inflation) could help real wages keep rising.

Targeted assistance: Recognize that affordability is distributed unevenly. Some households are doing fine; others are drowning. Targeted transfers to struggling households (expanded EITC, child tax credits, food assistance) provide relief where it’s most needed. To the Trump administration, “targeted assistence” is anathema.

Long-term: The fundamental issue is productivity growth. Sustainable improvements in living standards come from producing more with the same inputs. This requires investment in education, infrastructure, R&D, and technology—precisely the things Trump’s administration is gutting.

The affordability crisis isn’t just an economic issue—it’s a crisis of political legitimacy and social cohesion.

When large swaths of the population experience sustained declines in living standards or prolonged stagnation, they lose faith in governing institutions. This creates space for authoritarian appeals (”only I can fix it”), conspiracy theories (the economy is actually fine, you’ve been tricked), and social fragmentation (different groups blaming each other rather than addressing systemic issues).

The correct response to “people feel economically insecure” is not “your feelings are wrong” or “it’s a Democrat hoax.” The correct response is to take the concerns seriously, measure economic performance using metrics that capture lived experience, and implement policies that actually address the constraints people face.

Trump’s approach—deny the problem exists, blame Democrats/immigrants/the Fed, implement policies that worsen the problem—is not just economically counterproductive. It’s politically toxic and socially corrosive.

Appendix

It can be shown that the “affordability crisis” is much more than just a “high price level” phenomenon. Yes, the price level rose following the increase in inflation experienced in 2021 - 22, but as I argued in my last post, the Fed perceived this as the correct (optimal?) policy under the Covid “circumstances”.

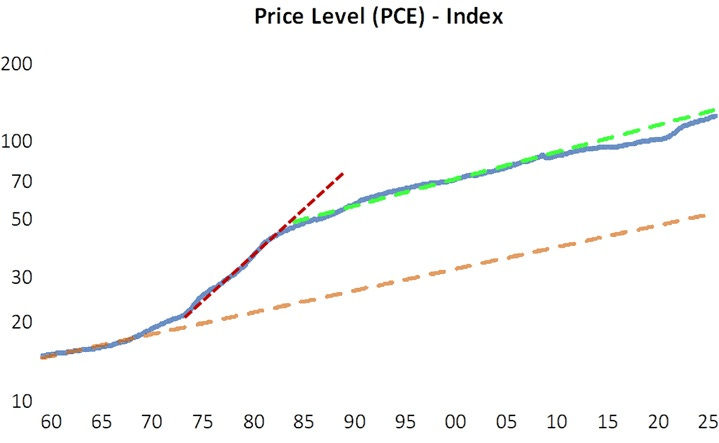

The chart below shows the 65 year history of the PCE price level. During the 1960s, inflation was close to 2%. During the 1970s the oil shocks, combined with mistaken monetary policies, increased inflation significantly, raising the price level permanently.

Following the Volcker adjusment in the early 1980s, inflation went back to the rate that prevailed in the 1960s, so that the price level trend was the same (the green dotted line has the same slope as the brown dotted line). Obviously, the price level itself was higher.

Up to the Great Recession, inflation was stable, so the price level rose along the trend level path (green dotted line). As I showed in the previous post, following the Great Recession, monetary policy remained “tight”. Both the level of NGDP and the price level dropped below the trend path.

Inflation (the rate of chenge in the price level) was also lower than the 2% target rate, with the price level falling below trend. When Covid hit in early 2020, inflation initially fell even more. In August 2020, the Fed unveiled its new monetary policy strategy, switching from Inflation Targeting (IT) to Flexible Average Inflation Targeting (FAIT).

With FAIT, the Fed would allow inflation to run above 2% after inflation had been running for some time below 2%, so that over a period it would be on average 2%. From looking at the chart, FAIT appears to mimic Price Level Targeting (PLT).

As the chart indicates, the increase in inflation observed in 2021-22 was “what was needed” to get back to the post 1984 price level trend path!

The price level we have today is almost exactly the price level that we would observe if there had been no Great Recession (and the “suffering” that it entailed).

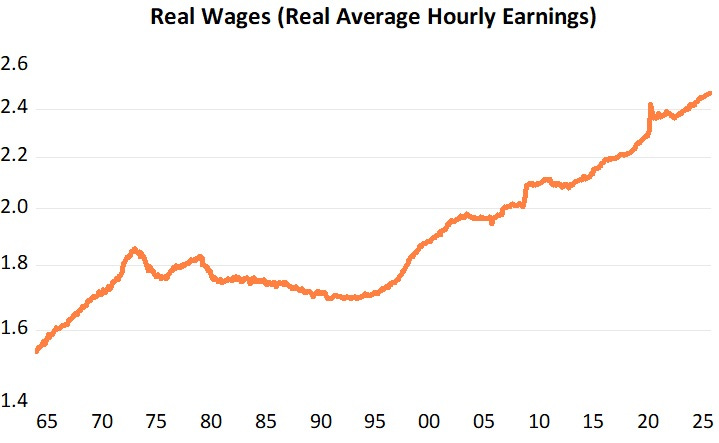

The next chart indicates that an “affordability crisis” was much more serious for a long period from the early 1970s, when inflation took off, to the mid 1990s, a period during which real wages were stagnant (with a downward bias). After the mid-1990s, real wages have risen almost continuously.

Together, the two charts above indicate that there are good reasons to believe that the price level and the associated level of real income by themselves give an incomplete picture of what people mean when they mention “affordability”. After all, the 1980s are not remembered for hopelesness.

In some important ways the current US economy is worse for workers than it looks by just looking at the price level and real wages.

Unemployment, although rising slowly, is still quite low by historical standards. However, hiring rates are falling and layoffs are rising. Workers are pessimistic about getting a job if they lose the one they have. This is corroborated by the rise in long term (more than 6 months) unemployment.

This makes a broad swath of workers feel excluded and insecure and the government´s policies not only don´t address these issues but make them worse. These sentiments were not present in the 1980s.

I need your support. If you value this work—the research, the analysis, the refusal to dumb things down—please consider becoming a paid subscriber. Your support will be greatly appreciated. Foregoing one cup of expresso a month is all it takes!

"With FAIT, the Fed would allow inflation to run above 2% after inflation had been running for some time below 2%, so that over a period it would be on average 2%."

You describe "Average Inflation Targeting, not "_Flexible_ Average Inflation targeting. FAIT allows a step increase in the level of prices with the target for inflation then returning to the average when relative prices are judged to have adjusted to the shock that required the step increase. The backward-looking average has nothing to do with it.

Placing obstacles to solar and wind projects is bad policy but can hardly affect "affordability" of electricity. Tariffs and deportations are enough. :)