There were many optimistic takes after the first quarter GDP release. One example from Greg Ip at the WSJ:

A burst of growth put the U.S. economy just a shave below its pre-pandemic size in the first quarter, extending what is shaping up to be a rapid, consumer-driven recovery this year.

But that was accompanied by a very pessimistic view on inflation. Just two weeks ago, following the release of the March CPI, Steve Henke wrote: “Why More U.S. Inflation Is Right Around the Corner”

The dramatic growth in the U.S. money supply, when broadly measured, that began in March 2020 will do what increases in the money supply always do.

Money growth will lead in the first instance (1–9 months) to asset-price inflation. Then, a second stage will set in. Over a 6–18-month period after a monetary injection occurs, economic activity will pick up.

Ultimately, the prices of goods and services will increase. That usually takes between 12 and 24 months after the original monetary injection.

Given this sequence, it’s as clear as the nose on your face that we’re going to see more — perhaps much more — inflation entering the system in the coming months.

(Note: In my view, his conclusion follows from wrongly interpreting Friedman´s Monetary Theory of Nominal Income - see here)

Today, Lars Christensen goes “ballistic”, predicting double digit inflation later this year in “Heading for double-digit US inflation”:

…over the last couple of months I have become more and more convinced that particularly elevated stock prices, property prices and commodity prices reflected sharply increased inflation pressures.

I have therefore, gradually changed my view on inflation and am now quite convinced that inflation will pick up very strongly in the US. In fact, I now seriously fear that we are heading for double-digit inflation in the US before the end of this year.

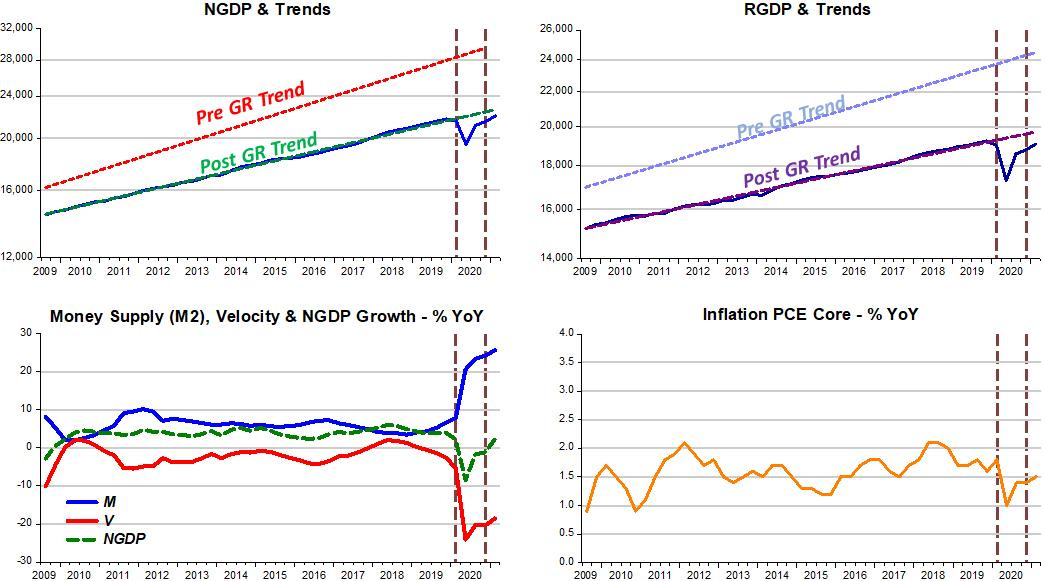

The panel below shows very clearly (at least to me) that monetary policy is the main driver of the economy. (Biden´s fiscal policy has other noble objectives, but cannot be confused with macroeconomic stabilization).

To note: After the fall “off the cliff” in 2008/09, NGDP evolves along what I call the “post GR Trend”. That happens because, as observed in the Money Supply Velocity & NGDP growth chart, monetary policy is sound enough to promote “nominal stability”. In other words, monetary policy is such that it adequately offsets changes in velocity, therefore keeping NGDP growth stable.

The first vertical bar indicates the moment that the Covid19 shock hits and its immediate and acute effect on velocity. Monetary policy reacted quite quickly, with money supply growth quickly rising. Velocity stopped falling and even rose a tick, but money supply growth continued to rise, thus causing a reversal in NGDP growth.

The second vertical bar shows that the “uptick” in both velocity and money growth in the first quarter of 2021 is reflected in a “magnified uptick” in NGDP growth.

The charts in the second column show that this latest increase in NGDP growth is reflected in a small uptick in both inflation and real growth.

The upshot is: If velocity continues to rise, money supply will have to be “juggled” so as to lead NGDP to at least its previous trend path (better if it goes further into the region between the pre and post NGDP trend path).

“Double digit” inflation will only be a concern if the Fed loses control over money supply growth. However, given that the Fed managed to adequately control money supply growth (in the sense of offsetting velocity changes so as to keep aggregate nominal spending (NGDP) on a stable growth path) both during the “Great Moderation” and after the end of the “Great Recession” (caused exactly because the Fed completely “missed the mark”), we can not give that a “high probability” of occurring.

Even if it were to occur isn’t the Fed then obligated to engineer an inflation “undershoot” per the AIT framework?