My main argument in yesterday´s post was that the Fed should not be focused on the labor market but on the strategy of monetary policy to guide an economy about to leave the Covid pandemic behind.

After publishing I read this: “Once Trump’s ‘enemy,’ Fed emerges as White House ally in rejecting concerns about overdoing stimulus”:

Federal Reserve Chair Jerome H. Powell is waving off concerns about an over-torqued economy producing long-feared inflation, saying the job market has a long way to heal before such fears are justified. In recent weeks, the position has been repeatedly embraced and cited by top Biden officials who make a similar argument when they say Congress needs to “go big” to ensure an economic revival.

As a result, the Fed and the White House appear closely aligned on policy — which can be a risky place for the central bank. With Powell at the Fed, and his predecessor Janet Yellen serving as treasury secretary, neither power center regards the potential dangers of overspending as a top concern.

The echoes from a distant past were “loud” (at least to me). In the 1960s, some “principles” were established by the high-powered economists at the Council of Economic Advisers (CEA).

In the early 1960s, at the CEA, James Tobin was setting forth the “principles” that should guide policy:

The “new economics” sought to liberate federal fiscal policy from restrictive guidelines unrelated to the performance of the economy.

The Council sought to liberate monetary policy to focus it squarely on the same macroeconomic objectives that should guide fiscal policy.

That´s just another way of saying that the “policy mix” should contemplate expansionary fiscal policies sanctioned by a monetary policy that kept the interest rate “low”.

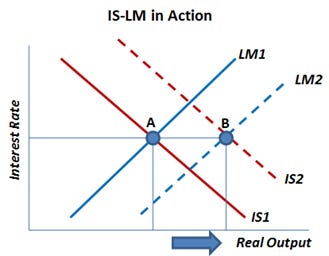

The workhorse model of the time, IS-LM, shows the rationale for Tobin´s “principles”. The tax cut would have maximal effect if monetary policy helped keep the interest rate “constant” so as not to discourage investment.

Ironically, Brad DeLong in 1997 wrote a paper on the 1970s, where we read:

“The Great Depression had taught everyone the lesson that business cycles were shortfalls below and not fluctuations around, sustainable levels of production and employment”.

Last week, Fed Governor Lael Brainard said in a speech:

[But] changes in economic relationships over the past decade have led trend inflation to run persistently somewhat below target and inflation to be relatively insensitive to resource utilization…

[Instead], the shortfalls approach means that the labor market will be able to continue to improve absent high inflationary pressures or an unmooring of inflation expectations to the upside.

Unfortunately, we know where the shortfalls approach of the 1960s led. My point, however, is that we don´t have to repeat the errors of the times, especially given the knowledge accumulated over the past half century.

Short-fall, output gap, etc. Rates-of-change can be positive or negative. It is the Delta (Δ) between, the oscillation between Roc’s in money flows, and Roc’s in inflation, on the given interval that’s critical. Whether it is in an increasing trend (a buy signal) or decreasing trend (a sell signal).

In contradistinction to N-gDp level targeting (money illusion), real money constructs can be used to determine whether an injection of new money is robust (a buy signal), net neutral, or harmful (a sell signal). The demarcation is exact as the distributed lag effects of money flows are exact. That is monetarism, macro-economics, is an exact science.

The FOMC's monetary policy objectives should be formulated in terms of desired rates-of-change, roc's, in monetary flows, volume times transaction's velocity, relative to roc's in the real-output of final goods and services -> R-gDp. I.e., R-gDp is the nominal anchor.

Roc's in N-gDp, or nominal P*Y, can serve as a proxy figure for roc's in all physical transactions P*T in American Yale Professor Irving Fisher’s truistic: “equation of exchange”. Roc's in R-gDp have to be used, of course, as a policy standard.